What is a Shipping Bill in Export? Meaning, Format, and Importance

When exporting goods from India, several customs procedures and documents are mandatory to ensure smooth clearance at ports and compliance with law. One of the most important documents in this process is the Shipping Bill. It serves as the primary customs declaration required to get approval for moving goods out of the country. This blog provides a detailed understanding of the shipping bill meaning, its format, types, and the critical role it plays in an export shipment.

What is a Shipping Bill? Meaning and Definition

A Shipping Bill is an official document filed with Indian Customs declaring the details of goods intended for export. It acts as a customs declaration and is mandatory for clearance of export shipments by air, sea, or land.

The shipping bill authorizes the customs department to inspect, assess, and allow goods to be exported legally. Without the approved shipping bill, goods cannot be loaded onto vessels or aircraft for export.

Purpose of a Shipping Bill in Export

- Customs Clearance: It is the key document to obtain customs permission to export goods.

- Goods Declaration: Details like quantity, description, value, destination, packaging, and transport are clarified in the shipping bill.

- Duty Drawback Claims: Exporters use it to claim refunds of duties/taxes paid on imported raw materials.

- RBI Compliance: Helps the Reserve Bank of India track foreign exchange earnings arising from exports.

- Legal Record: Serves as a legal acknowledgment of goods leaving India under the exporter’s license.

What Does a Shipping Bill Include? (Key Details)

A typical shipping bill contains the following information:

- Exporter’s and buyer/importer’s details (name, address, GST, IEC)

- Customs agent information

- Vessel or flight number used for transportation

- Port of loading and destination discharge details

- Cargo description including gross and net weight

- Number and marks of packages

- Commercial invoice number and value, payment terms

- GST and duty drawback details where applicable

- Terms of shipment like FOB (Freight on Board), CIF (Cost Insurance Freight), etc.

- Container numbers (if applicable)

- Declaration and signature by the exporter and customs officers

Common Formats of Shipping Bill

The shipping bill is filed electronically via the ICEGATE portal. In rare cases, physical forms are accepted. The layout generally follows structured customs templates with fields for all required data.

Shipping Bill Types Based on Purpose

- Drawback Shipping Bill (Green): Used when claiming refund of duties paid on inputs used for exports.

- Duty-Free Shipping Bill (White): For goods exported under duty-free benefits without drawback claims.

- Dutiable Shipping Bill (Yellow): When export duty is payable on goods.

- Ex-Bond Shipping Bill (Pink): For goods stored in bonded warehouses and later re-exported.

- Export Promotion Shipping Bill (Blue): For exports under export promotion schemes like DEPB or EPCG.

How to Generate a Shipping Bill?

- Prepare all export documentation: commercial invoice, packing list, IEC, etc.

- Register and file shipping bill electronically on the ICEGATE portal.

- Fill all fields accurately matching invoice and shipment details.

- Submit for customs assessment where inspection may be conducted.

- Customs issues “Let Export Order” and “Let Ship Order” authorizing movement.

- Exporter retains a copy for RBI reporting and export records.

How to File a Shipping Bill on ICEGATE Portal

Exporters can file their shipping bill electronically through the ICEGATE portal (Indian Customs EDI Gateway).

Steps to file:

- Register on ICEGATE.

- Log in with your credentials.

- Fill in details of the shipping bill (exporter, consignee, invoice, goods).

- Upload supporting documents (Invoice, Packing List, IEC, AD Code, etc.).

- Submit the bill electronically for customs processing.

- Once approved, a Shipping Bill Number is generated.

Importance of Shipping Bills for Exporters

- Acts as proof of export for government incentives and tax benefits.

- Ensures legal and smooth clearance of exports without delays.

- Helps exporters monitor and reconcile foreign exchange earnings.

- Maintains transparency in trade and facilitates export documentation audits.

- Supports claims under FTP (Foreign Trade Policy) by providing export evidence.

Role of Shipping Bill in Export Incentives

A properly filed shipping bill is mandatory for:

- Duty Drawback

- GST Refunds on Exports

- MEIS/RODTEP Schemes by DGFT

- Other government incentives provided to exporters

Thus, exporters should ensure accuracy and completeness while filing.

Common Mistakes to Avoid in Shipping Bill Filing

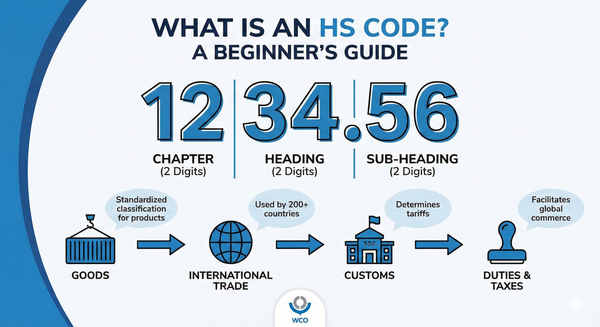

- Wrong HS code classification

- Incorrect invoice value or currency

- Missing IEC or AD Code registration

- Errors in port of loading or destination

- Mismatched details between invoice and shipping bill

Avoiding these mistakes helps exporters prevent delays, penalties, and rejections.

Conclusion

The shipping bill is a cornerstone export document in India, ensuring proper legal formalities, smooth logistics, and fiscal compliance. Exporters must familiarize themselves with its format, types, and filing procedure to facilitate seamless international trade.

FAQs – Shipping Bill in Export

1. What is a shipping bill in export?

A shipping bill is a customs clearance document required for exporting goods from India. It acts as legal proof of export.

2. Is a shipping bill mandatory for exports?

Yes, a shipping bill is mandatory for all exports from India. Without it, customs will not allow goods to be shipped.

3. How can I check my shipping bill status?

You can check the shipping bill status online through the ICEGATE portal using the shipping bill number.

4. What documents are required for filing a shipping bill?

Exporter’s IEC, AD code registration, commercial invoice, packing list, and export declaration are required.

5. Can a shipping bill be amended?

Yes, amendments are allowed, but they require customs approval and valid justification.

6. What is the difference between a shipping bill and a bill of lading?

A shipping bill is a customs clearance document, while a bill of lading is a transport document issued by the carrier.

7. How long does it take to generate a shipping bill?

If all details are correct, a shipping bill can be generated within a few hours on the ICEGATE portal.

8. Can a shipping bill be filed offline?

Today, most shipping bills are filed electronically through ICEGATE for faster processing.

9. Is a shipping bill required for SEZ units?

Yes, SEZ units also need to file a shipping bill for exporting goods, though some processes may vary.

10. How does EximPe help in shipping bill-related compliance?

EximPe ensures exporters get smooth compliance support, reliable payments, and faster documentation for exports.