What Is IEC Code? Full Form, Registration, Verification and Updation Check

IEC stands for Importer-Exporter Code, Before 2017 it used to be a 10-digit unique identification number but after introduction of GST in 2017 the Importer-Exporter Code for firms in India became the same as their PAN (Permanent Account Number), though you still need to apply it via the Directorate General of Foreign Trade (DGFT) under India's Ministry of Commerce and Industry. Without an IEC, no shipment can legally clear customs, and no government trade incentives can be accessed for import export transactions. An IEC is a one-time registration document that needs to be updated every year between April 1st and June 30th, making it the foundation of every import-export business in India.

What Is an IEC Code?

IEC full form is Importer-Exporter Code.

An Importer-Exporter Code (IEC) is not just a number, it's your legal permission to carry out export-import business in India. Think of it as your business's passport for cross-border commerce. This document is by default linked with the IDPMS and EDPMS system via Icegate portal, which track, regulate, and verify all import and export transactions conducted by businesses in India.

The IEC Format: Understanding the 10 Digits

After 2017 IEC is PAN-based, meaning it's the same as your PAN number that you get from the Income Tax Department. But, you still have to separately apply for it via DGFT.

Real Meaning and Purpose of IEC: What It Does

An IEC serves five primary purposes in India's foreign trade system

- Government Identification & Tracking

- Customs Clearance Process

- Access to Trade Incentives & Government Schemes.

- GST Refund

- Foreign Exchange Transaction for Trade

How IEC Is Different from Other Trade Documents

Many importers get confused between IEC, Import License, and AD Code. These three are very important documents to import-export operations in India, but they serve different purposes. Let's clarify:

IEC vs. Import License vs. AD Code (Complete Comparison Table)

Who Needs an IEC Code?

Any person or entity engaged in importing or exporting goods from India generally needs an IEC Code. This includes:

- One Person Company (OPC)

- Proprietor

- Partnership

- LLP

- Private limited company

- Hindu Undivided Families (HUFs)

The IEC Registration Process: Step-by-Step

IEC registration is 100% online through DGFT portal (dgft.gov.in). It typically a real time process, sometimes takes 1-2 hours after document submission.

Documents You Need Before Applying

For All Applicants:

- PAN Card (self-attested copy)

- Permanent Account Number itself (typed in application)

- Aadhar Card or Passport (scanned copy)

- Address proof (electricity bill, rent agreement, or property document)

- Bank details (cancelled cheque)

- Digital photograph (recommended size: 100x100 pixels)

- Scanned signature

- Valid email and mobile number (for OTP verification)

For Proprietors (New as of January 2025):

- Aadhar-based E-KYC verification is now mandatory

- Complete biometric verification through DGFT portal

- This replaces traditional ID verification

For Partnerships:

- Partnership Deed

- PAN of all partners

- Authority letter authorising signatory

- Address proof of all partners

For Companies/LLPs:

- Certificate of Incorporation

- Board Resolution authorising IEC application

- PAN of company

- Memorandum and Articles of Association (MOA & AOA)

- Director identity and address proofs

Step-by-Step Application Process

Step 1: Visit DGFT Portal

- Go to

- www.dgft.gov.in

- Click "Apply for IEC"

- Select "New Registration" (not amendment)

Step 2: Register an Account

- Provide email address and mobile number

- Receive OTP on both email and SMS

- Verify OTP for account activation

- Create login username and password

Step 3: Fill ANF Form 2A

- This is DGFT's standard IEC application form

Step 4: Upload Documents

- Upload scanned copies in prescribed formats (typically PDF/JPG)

- File sizes must be within limits (usually 100KB-1MB per document)

Step 5: Digital Signature or Aadhar

- Sign application using Digital Signature Certificate (DSC), or

- Use Aadhar-based e-signature (for proprietors, now mandatory)

- Verify through OTP if using Aadhar

Step 6: Submit and Pay Fee

- Review all details carefully before clicking "Submit"

- Pay ₹500 registration fee online

Step 7: Wait for Processing

- Realtime, sometimes take 1-2 hours

- DGFT processes your application

- If documents are incomplete, you'll receive rejection notice with details

Step 8: Download IEC Certificate

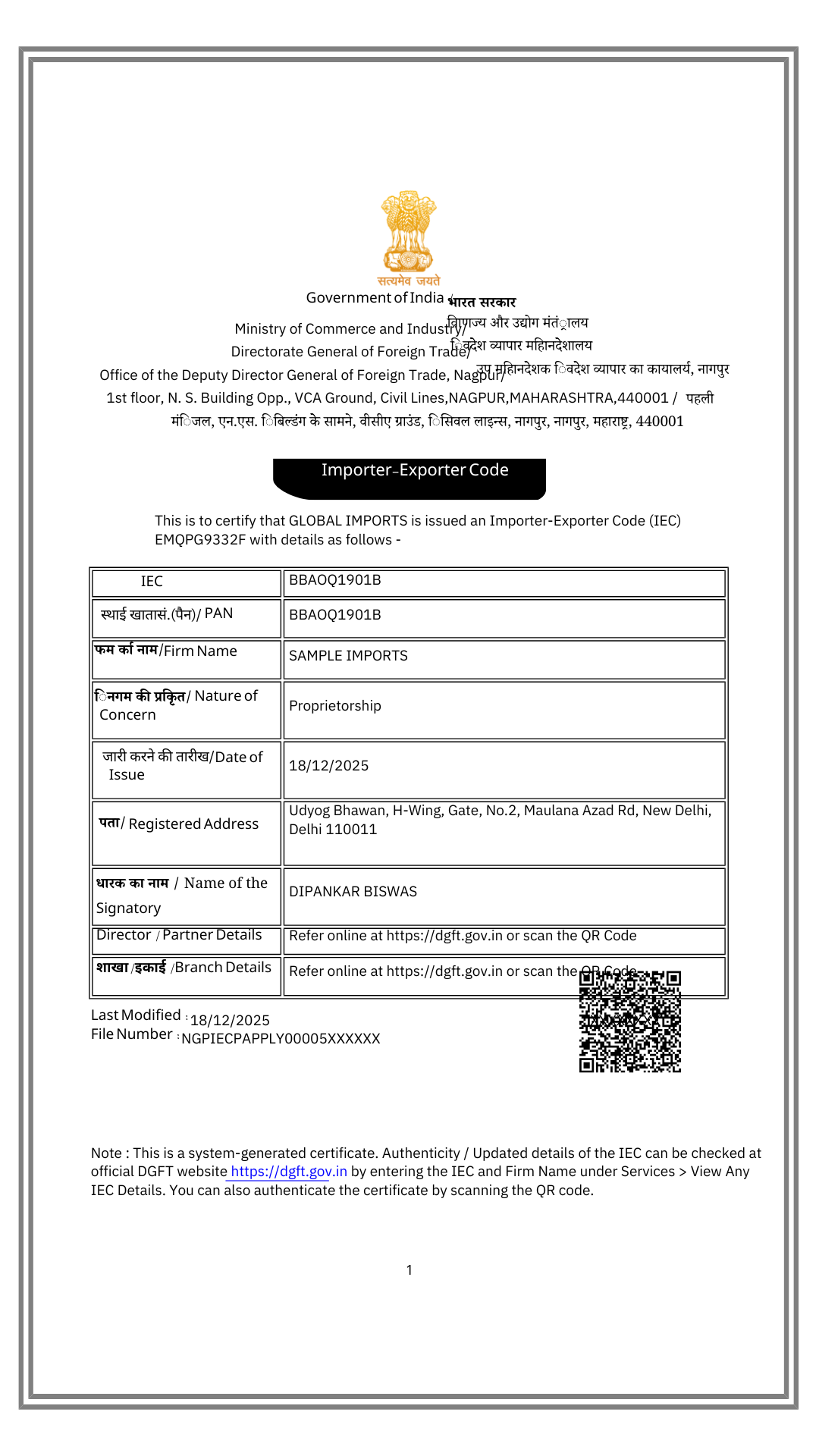

- Once approved, download PDF IEC Certificate from DGFT dashboard

- This certificate is your official proof

- No physical certificate is issued (it's entirely digital)

- You can print it or keep digital copy

Compliance Requirements: What You Must Do After Getting IEC

IEC isn't a "set and forget" document. There are ongoing compliance obligations:

Annual Update (Mandatory)

Frequency: Every 12 months after IEC issuanceMethod: Online update on DGFT portalTime Required: 5-10 minutesConsequences of Missing: IEC deactivation → Cannot clear shipments

What You Update:

- Current office address (if changed)

- Bank account details (if changed)

- Nature of business/products (if expanded)

- Contact information (if changed)

If nothing has changed, it still needs to be updated with the same information.

FAQ: Answers to Real IEC Questions

Q: Can I get IEC as an individual or do I need a company?

A: Yes, you can get IEC as an individual proprietor, partnership, or company. Each structure has different requirements, but IEC is available to all.

Q: How long does IEC registration take?

A: Usually real time after successful document submission and payment. If DGFT requests additional documents, it may take longer.

Q: Can I have multiple IEC codes?

A: No. Your business can have only one IEC, linked to one PAN. Multiple IEC applications trigger fraud alerts.

Q: What if I don't update my IEC annually?

A: Your IEC becomes deactivated after 12 months of no update. Once deactivated, customs cannot clear your shipments. You can reactivate it by filing the annual update (same process, takes 1-2 days).

Q: What if my business details change after getting IEC?

A: File an IEC amendment on DGFT portal. Amendment typically takes 3-5 working days to process.

Q: Can customs reject my shipment if IEC is not properly linked to ICEGATE?

A: Yes. If ICEGATE shows your IEC as inactive or unlinked, customs will not clear your shipment. Always verify your ICEGATE account is active before shipment.

Q: What happens to my IEC if I close my business?

A: IEC remains registered but unused. However, if you plan to restart trading, you'll need to update it again.