Topmate.io: Alternatives for International Payments, Earning Money & EximPe Comparison

Topmate is an all-in-one platform that lets creators monetize their expertise through 1:1 calls, webinars, and digital products. But here's the honest truth, most creators earn virtually nothing. Success requires an existing social media following and genuine expertise. Let's break down whether it's actually worth your time.

What Is Topmate.io?

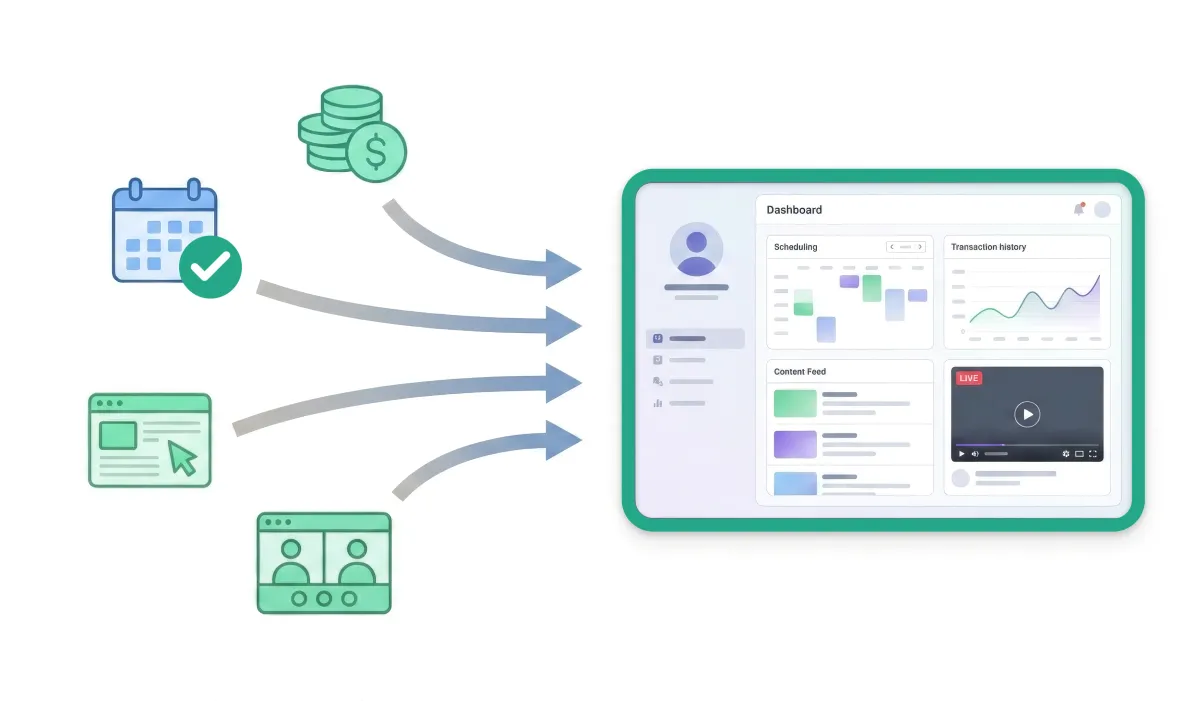

Topmate is a creator economy platform launched in 2020 that lets professionals package their knowledge into sellable services. Instead of juggling multiple tools—Calendly for bookings, Stripe for payments, a separate website, you get one link that handles scheduling, payments, testimonials, and product sales.

Think of it as a storefront for your brain. A designer can sell logo consultations. A developer can offer mock interview prep. A marketer can run webinars on growth strategies. The platform handles the entire transaction flow, from booking to payment to customer feedback.

Over 300,000 creators use Topmate globally, and the platform has generated $1M+ in creator earnings. The platform was valued at ₹33.3 CR ($4M) as of January .

The Real Earnings Breakdown: What Creators Actually Make

Before considering Topmate, you need to understand the earnings distribution.

| Creator Tier | Monthly Earnings | What This Means |

|---|---|---|

| Bottom 80% | Less than ₹5,000/month | Barely anything; inconsistent bookings |

| Top 5% | Around ₹5,000/month | Part-time side income |

| Top 1% | ₹20,000+/month | Meaningful income |

The critical insight? Nearly everyone making ₹5,000+ monthly was already successful elsewhere. They're micro-influencers, recognized engineers at FAANG, or established consultants. Topmate didn't create their income, it just gave them another distribution channel.

International Payments & Hidden Costs: Getting Payments from India While Sitting Abroad

If you're based abroad and receive payments from Indian customers through Topmate, you're losing 15-16% to hidden forex markups and fees. You can use any alternate platform like Calendly with EximPe to cut this to just 2-3%, that saves you around ₹7,000-10,000 monthly on ₹50,000 in earnings.

The Hidden Fee Reality of Collecting Payments from India

When an Indian customer pays a creator sitting outside India via Topmate, the effective fee is NOT 10%—it's 16-18%. Here's why:

Example: $100 session from Indian customer:

| Fee Component | Rate | Amount | Who Charges |

|---|---|---|---|

| Platform Commission | 10% | $10 | Topmate |

| Payment Gateway Processing (International) | 3% | $3 | Razorpay/Stripe |

| Currency Conversion Markup | 2-3% | $2-3 | Razorpay/Stripe (embedded) |

| PayPal/Transfer Fee (if applicable) | 1-2% | $1-2 | PayPal/Wire services |

| TOTAL EFFECTIVE FEE | — | $16-18 | Combined |

| Creator Receives | — | $82-84 | From $100 |

Effective Fee Rate: 16-18% (Not the advertised 10%)

Monthly Income Impact

Realistic case: Designer receiving ₹50,000/month ($600/month) from Indian clients

Via Topmate:

- Platform commission: ₹5,000 (10%)

- Gateway fees: ₹1,800 (3%)

- Currency conversion loss: ₹1,200 (2%)

- Total lost to fees: ₹8,000/month (~13.3%)

- Net income: ₹42,000/month

- Annual cost: ₹96,000 in hidden fees

You're spending nearly ₹8,000 monthly to process ₹50,000 in payments. Is Topmate's convenience worth that tax?

Comparison: Topmate vs Standard Payment Processors vs EximPe

Topmate costs 3-5X more than alternatives for international payments.

The RBI Compliance Issue: Why This Matters

This is where regulatory risk enters the picture—something Topmate doesn't openly discuss.

Topmate's Missing Authorization

The Regulation: Since October 2023, the RBI requires all entities facilitating cross-border payments to obtain PA-CB (Payment Aggregator - Cross Border) authorization.

Topmate's Status: Topmate's Terms of Use (updated Dec 1, 2025) lists compliance with the Indian Contract Act, IT Act 2000, and DPDP Act—but makes NO mention of RBI PA-CB authorization or Payment Aggregator licensing.

By operating as an intermediary platform processing payments between Indian customers and creators abroad, Topmate may actually qualify as a PA-CB itself, which requires RBI authorization. Currently, no public announcement confirms Topmate holds this license.

If enforcement action occurs, creator accounts could face:

- Withdrawal delays (5-30+ days instead of promised 1-7 days)

- Account freezes with pending payments trapped

- Forced fund conversions to INR

- Unresponsive support during resolution

EximPe: The RBI-Compliant Alternative for International Payments

If you're currently using Topmate to receive payments from Indian customers while based abroad, EximPe offers a significantly cheaper, fully compliant alternative.

How EximPe Works (For Collecting Payment from India)

EximPe is an RBI-authorized Payment Aggregator for Cross-Border (PA-CB-E&I) that lets you:

- Receive payments from 150+ countries

- Collect in INR from Indian customers

- Settle in USD, EUR, GBP, SGD, AED, HKD to global bank accounts

- Get compliance documents (FIRA) automatically

Key Advantage: Zero forex manipulation, you get live interbank rates that is up to 50% cheaper, transparent markup, not hidden 2-3% embedded conversions.

Compliance Advantage

- EximPe: RBI PA-CB authorized (since July 2025)—zero regulatory risk

- Topmate: No PA-CB authorization—potential regulatory exposure

FAQ: Questions Creators Actually Ask

Topmate says 10% commission. You're saying 15-16%. What's the difference?

Topmate's 10% is just the platform fee. When Indian customers pay you, the money goes through payment processing (3% fee) + currency conversion (2-3% hidden markup) = 15-16% total.

Can I use EximPe if I don't have an Indian bank account?

Yes, You jus need a bank account somewhere to receive settlements.

Topmate advertises '2.9% transaction fees.' Where does 3% gateway come from?

Topmate's 2.9% is the BASE rate for domestic Indian payments. International payments from India to abroad have a HIGHER rate (3%+).

Is the 2-3% forex markup standard across all platforms?

No. Some platforms use transparent mid-market rates (0% markup). Others hide 2-4% markups. Topmate's is hidden (2-3%).

Why should I split between Calendly and EximPe instead of using Topmate all-in-one?

Splitting costs 70% less. Topmate is convenient but expensive. For international payments, the savings justify a small extra setup.