What Is ICEGATE? Complete Guide to Registration, Login, Bill of Entry e-Payment

What is ICEGATE?

ICEGATE (Indian Customs Electronic Data Interchange Gateway) is the official online portal of Indian Customs where importers, exporters, and customs brokers file all customs documents electronically. ICEGATE enables electronic filing of Bills of Entry (imports), Shipping Bills (exports), IGM (Integrated Manifest), and online payment of customs duties. ICEGATE is the digital gateway for all international trade through India, managed by the Central Board of Indirect Taxes and Customs (CBIC). Understanding ICEGATE login process, how to file documents, download shipping bills, and register AD codes is critical for any importer or exporter operating in India.

What Is ICEGATE?

ICEGATE stands for Indian Customs Electronic Data Interchange Gateway. It is the government of India's official electronic commerce portal developed and managed by the Central Board of Indirect Taxes and Customs (CBIC) under the Ministry of Finance.

ICEGATE acts as your digital bridge between your business and Indian Customs. ICEGATE offers various trade related services like e-filing of Bill of Entry (BOE), e-filing of Shipping Bill (SB) and end to end IGST refund etc.

ICEGATE has more than 300,000+ importers, exporters, customs brokers, and shipping agents and processes around ₹50,000+ crores in customs duties annually through e-payment.

Major Trade Services Offered by ICEGATE

ICEGATE is not just for filing BOEs and SBs. It's a complete customs management portal. Below are some of the important services provided by ICEGATE:

1. File Import Documents (Bill of Entry)

2. File Export Documents (Shipping Bill)

3. Submit IGM (Integrated Manifest)

4. Track Shipment Status

5. Pay Customs Duties Online

6. Register AD Code (Authorized Dealer Code)

7. Upload Documents via e-Sanchit

8. Check License Status

9. Apply for IPR Registration

10. Access Trade Information

Benefits of Registering at ICEGATE

Who Can Log Into ICEGATE?

- Importers (with valid IEC)

- Exporters (with valid IEC)

- Customs House Agents (CHA) / Customs Brokers

- Freight Forwarders

- Shipping Lines and Agents

- Authorized Dealers (Banks)

- Port Authorities

Documents Required to Register on ICEGATE

Below are the list of documents required to register on ICEGATE:

✓ Valid IEC (Importer-Exporter Code from DGFT)

✓ GSTIN (GST Registration Number)

✓ PAN (Permanent Account Number of company/individual)

✓ Valid Email ID (registered with GSTN and DGFT)

✓ Valid Mobile Number (registered with GSTN and DGFT)

✓ Class 3 Digital Signature Certificate (DSC)

✓ Active bank account (for payments)

Important: Your email and mobile number MUST be registered with both GSTIN (GST authority) AND DGFT (if you're an importer/exporter). If they don't match, registration might fails.

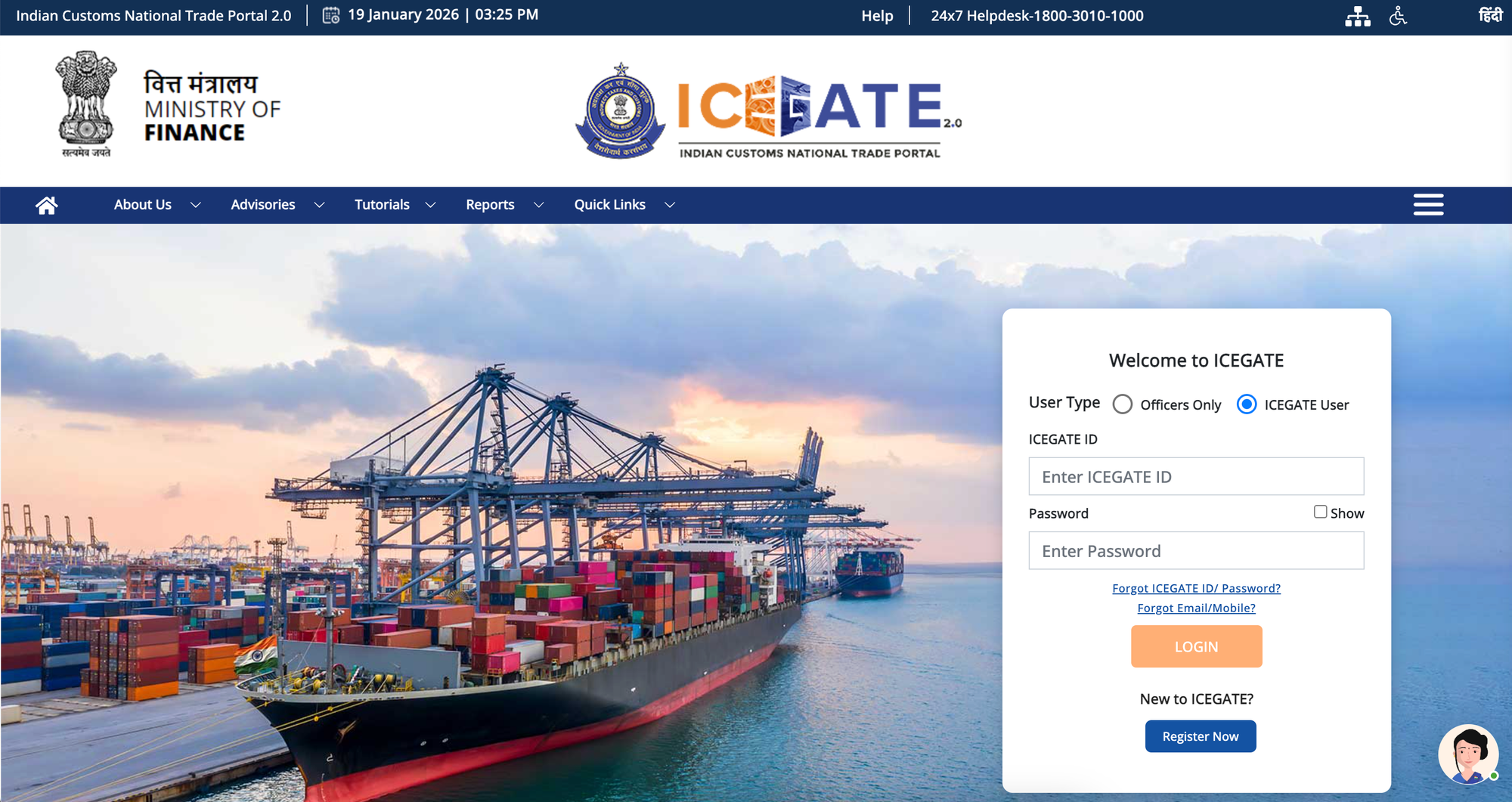

ICEGATE Registration: Step-by-Step Process

The ICEGATE registration process is fully online & can be done by anyone.

Step 1: Visit ICEGATE Website

Step 2: Click "Register Now"

Step 3: Select User Type

Step 4: Verify GSTIN

Step 5: Verify IEC

Step 6: Verify Contact Details

Step 7: Verify OTPs

Step 8: Upload Digital Signature Certificate (DSC)

Step 9: Complete Role Registration

Step 10: Submit for Approval

Step 11: First Login

Once approved, you can log in using:

- User ID: Your IEC (for importers/exporters) or CHA code

- Password: Password you created during registration

- CAPTCHA: Verify you're human

Authorized Banks for Online Customs Duty Payments Via ICEGATE

When you pay customs duties through ICEGATE e-Payment Gateway, you can only pay through these Authorized Banks:

List of Authorized Banks for ICEGATE Payment

- Axis Bank

- Bank of Baroda

- Bank of India

- Punjab and Sind Bank

- Canara Bank

- Central Bank of India

- Dhanlaxmi Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Karnataka Bank

- Karur Vysya Bank

- Kotak Bank

- Punjab National Bank

- RBL Bank

- South Indian Bank

- State Bank of India

- UCO Bank

- Union Bank of India

- Indusind Bank

How to Make ICEGATE Payment Through Authorized Banks

Paying Customs duty is very crucial for timely assessment and delivery of the imported goods.

Step 1: Log Into ICEGATE

Step 2: Click "e-Payment"

Step 4: Click Search

Step 5: Select Challan to Pay

Step 6: Choose Bank

Step 7: Click "Proceed to Bank"

Step 8: Log Into Bank's Internet Banking

Step 9: Confirm Payment

Step 10: Authenticate Payment

Step 11: Payment Successful

Step 12: Return to ICEGATE

ICEGATE FAQ: Quick Answers

Q: Is ICEGATE registration mandatory?

A: YES. If you import or export anything, you must have an ICEGATE registration.

Q: What is the cost of ICEGATE registration?

A: FREE. ICEGATE registration costs nothing.

Q: How long does ICEGATE registration approval take?

A: Usually 1-3 working days. Sometimes up to 5 days during high volume.

Q: Can I change my ICEGATE password?

A: Yes. After login, go to Profile → Change Password. Enter old password and new password twice, then save.

Q: What if I forget my ICEGATE password?

A: Click "Forgot Password" on login page. Enter your User ID (IEC). OTP is sent to registered email/mobile. Create new password using OTP.

Q: Can I download BOE after clearance?

A: YES. Go to Services → Document Download → Bill of Entry. Enter BOE details and download the PDF copy.

Q: Is there a fee for downloading documents from ICEGATE?

A: No. Document download is completely free. Download as many times as needed.