Certificate of Origin (COO): The Complete Guide for Importers & Exporters

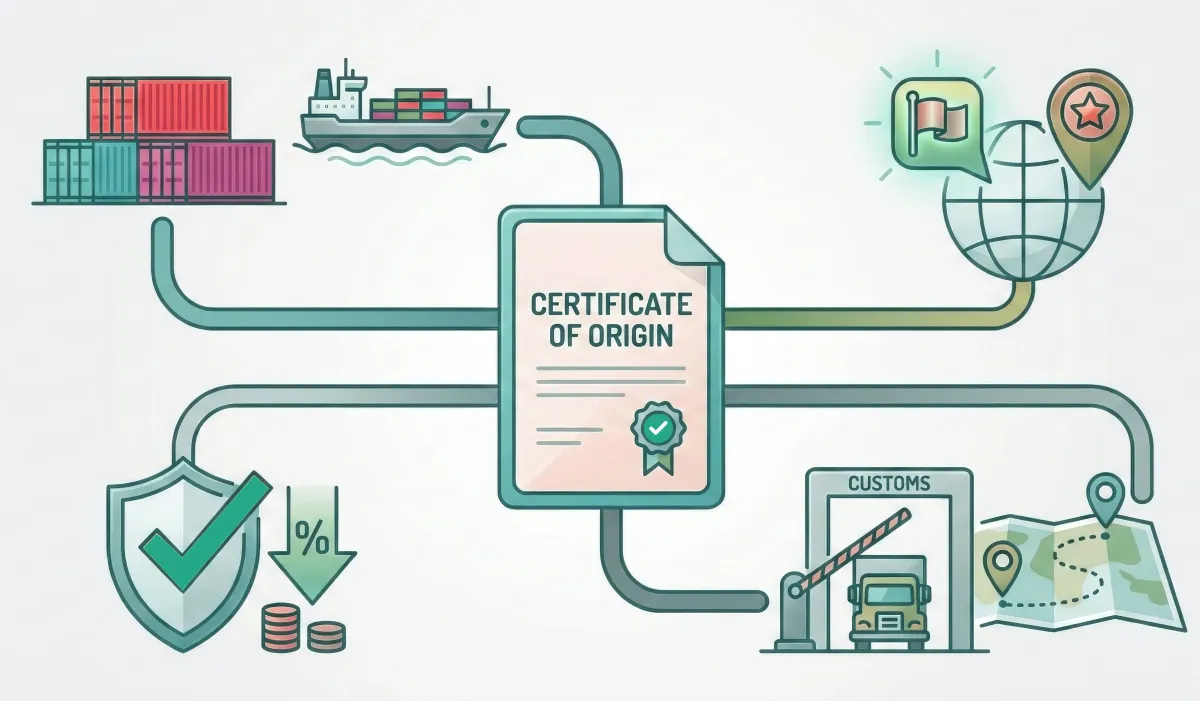

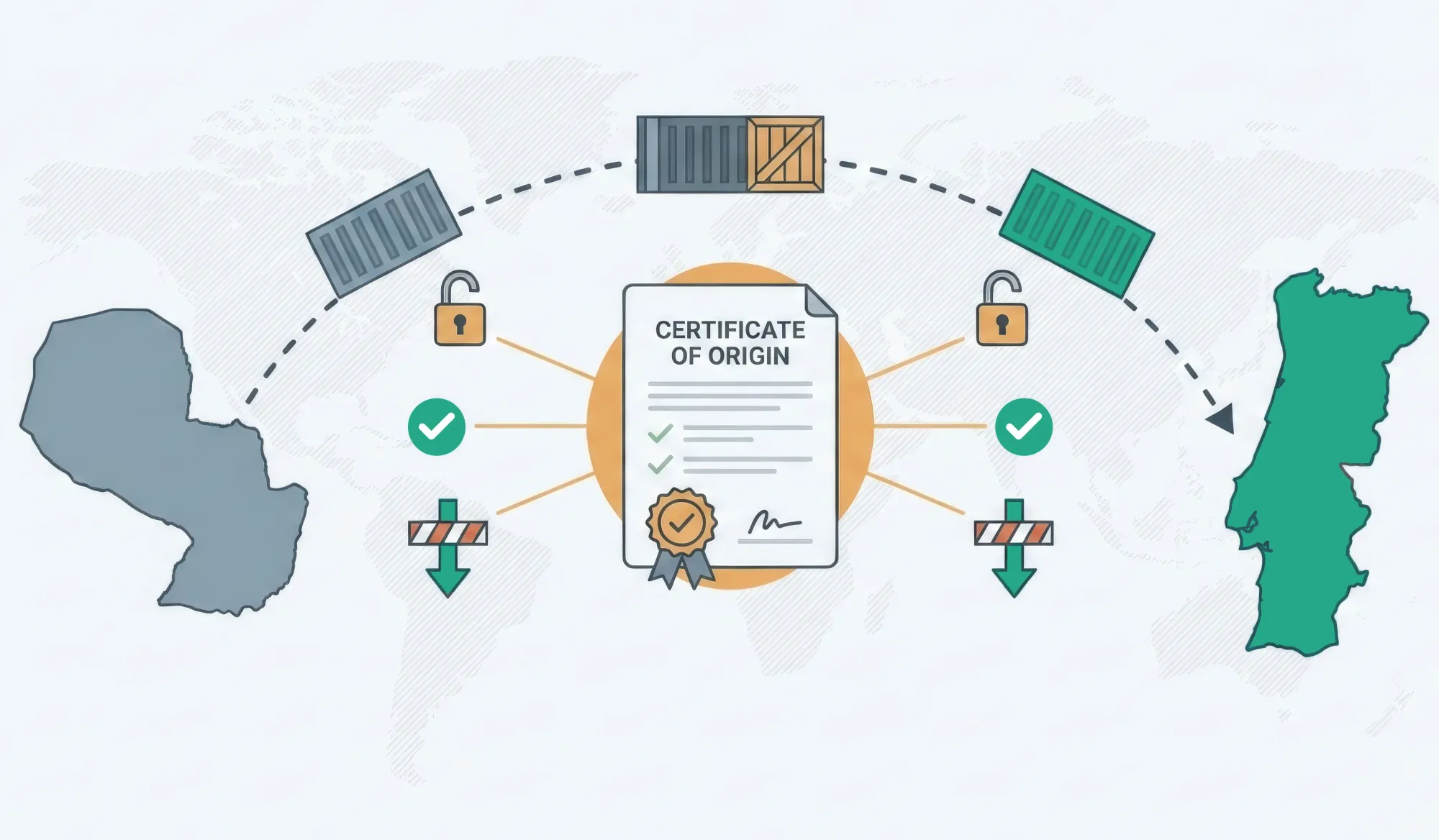

A Certificate of Origin (COO) is a fundamental international trade document that certifies the country where goods were manufactured, produced, or processed. For importers, this document determines the customs duties payable and eligibility for preferential tariff benefits under Free Trade Agreements (FTAs). For exporters, it serves as proof of origin that enables buyers to claim duty concessions in the destination country.

What is a Certificate of Origin (COO)?

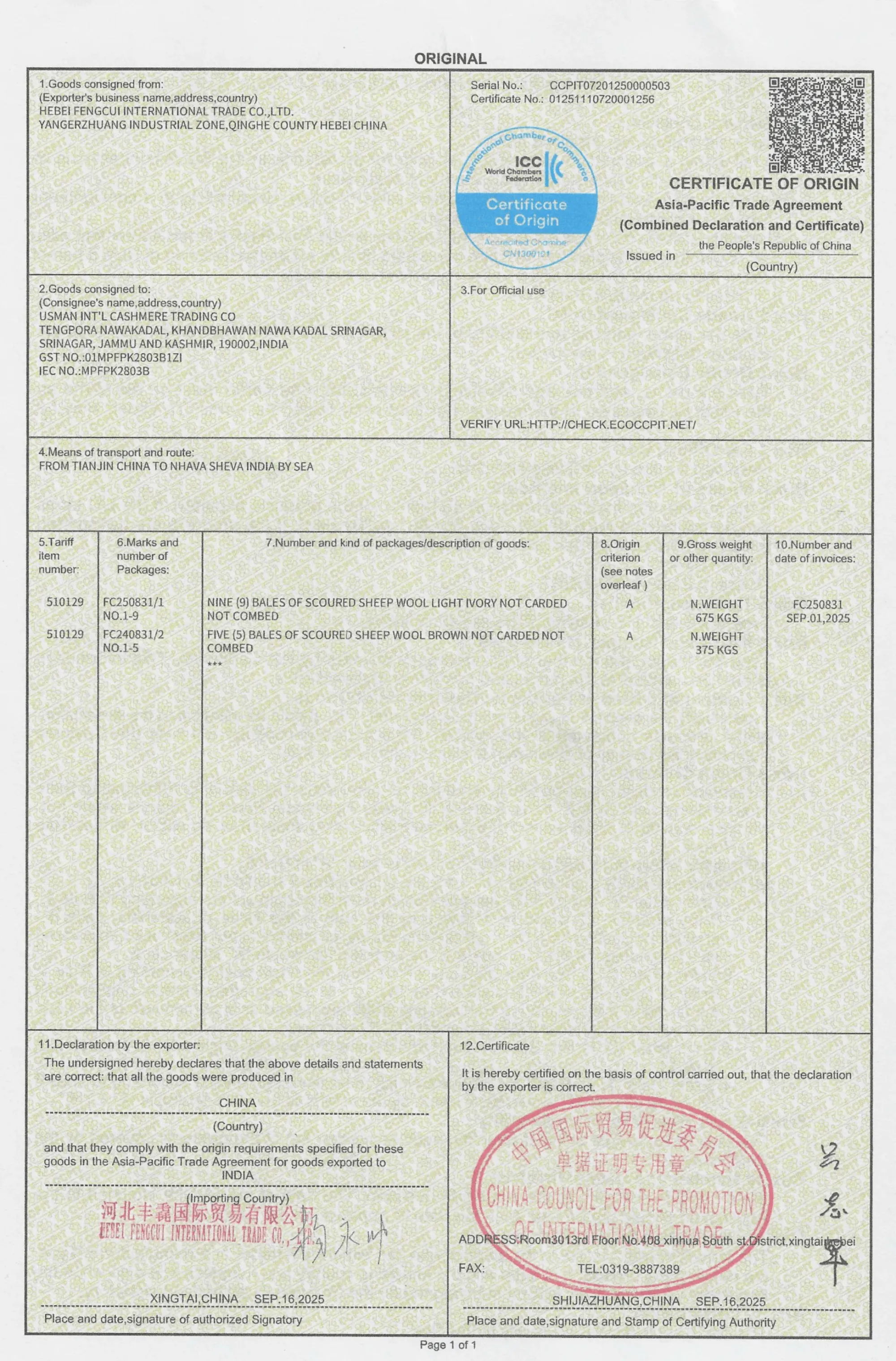

A Certificate of Origin is an official document that verifies the commercial nationality of a product, essentially declaring which country the goods originate from. It contains critical information including the product description, destination country, exporting country, and details about the exporter and importer.

The COO serves multiple purposes in international trade:

- Customs clearance: Required by customs authorities to verify where goods came from and apply appropriate tariffs

- Duty determination: Helps determine whether goods qualify for reduced or zero customs duties under trade agreements

- Trade policy compliance: Ensures compliance with import quotas, anti-dumping measures, and embargoes

- Letter of Credit requirements: Often mandatory for transactions financed through letters of credit

Compliance Under CAROTAR 2020

The CAROTAR (Customs Administration of Rules of Origin under Trade Agreements) Rules, 2020 places significant obligations on Indian importers:

- Due diligence requirement: Importers must satisfy themselves that imported goods meet originating criteria before claiming preferential rates

- Documentation: Importers must obtain basic information from exporters about the production process, origin criteria, and inputs used

- Record keeping: All documents related to origin claims must be retained for at least 5 years

If customs authorities are not satisfied with the proof of origin, preferential duty benefits can be denied, and importers may face penalties along with recovery of differential duties.

Customs Clearance

Presenting a valid COO at the time of import is essential for certificate of origin customs clearance. Customs officers verify the authenticity of the certificate, check whether the goods match the description, and confirm compliance with the specific FTA's rules of origin. Discrepancies can lead to delays, additional scrutiny, or outright rejection of preferential treatment claims.

Types of Certificate of Origin

There are two types of Certificate of Origin, Preferential and Non-Preferential.

Preferential Certificate of Origin

A preferential certificate of origin is issued under specific Free Trade Agreements or Preferential Trade Agreements between countries. It allows exported goods to benefit from reduced or zero customs duties in the destination country.

Non-Preferential Certificate of Origin

A non-preferential COO certifies the country of origin but does not grant any tariff advantages. It serves regulatory, statistical, and administrative purposes.

Rules of Origin Criteria

For goods to qualify for preferential tariff rates, they must satisfy one of these origin criteria:

- Wholly Obtained: Goods entirely produced in the exporting country using only local materials (e.g., agricultural products, minerals, livestock)

- Substantial Transformation: Goods undergo sufficient processing that changes their tariff classification

- Regional Value Content (RVC): A minimum percentage of the product's value must originate in the FTA region

- Product-Specific Rules (PSR): Specific criteria for certain product categories

How to Verify Certificate of Origin (For Importers)

Verifying the authenticity of a certificate of origin is crucial to avoid penalties and ensure legitimate duty claims. Indian customs authorities actively verify COOs, and non-authentic certificates can result in duty recovery with interest and penalties.

Verification Steps

- Visual Inspection

- Check for authorized signatures and official stamps/seals

- Verify the certificate format matches the FTA requirements

- Ensure all mandatory fields are completed

- Cross-reference with Shipping Documents

- Description of goods matches commercial invoice and packing list

- Quantity and weight correspond with Bill of Lading

- Consignee details are accurate

- QR Code Verification

- Electronic COOs from India feature QR codes for instant verification

- Scan the QR code to access certificate details

- Online Verification

- For Indian eCoOs: Visit trade.gov.in → Get Certificate of Origin → Verify Certificate

- Enter the COO certificate number and captcha to verify authenticity

- ICC's CO verification website for non-preferential certificates from accredited chambers

- Specimen Signature Verification

- India's FTA Cell maintains specimen signatures and seals of authorized officials from partner countries

- These are uploaded on the ICES portal for customs officers to verify

Electronic Certificate of Origin (eCO) - 2026 Update

The global shift toward paperless trade has accelerated the adoption of electronic certificates of origin. As of 2026, significant developments have transformed how COOs are issued and verified.

India's eCoO 2.0 Mandate

From January 1, 2025, India made electronic filing mandatory for all Certificates of Origin through the eCoO 2.0 platform. Manual certificates issued after this date are declared null and void, and partner countries' customs authorities have been notified to reject manually issued certificates.

Current System Capabilities:

- Real-time verification through QR codes

- Online verification portal at trade.gov.in

- Image seal and signature embedded in electronic certificates

- Processing capacity of 7,000+ certificates daily

- Integration with 125 issuing agencies

Benefits of Electronic COO

- Faster processing: Same-day issuance in most cases

- Reduced fraud: Digital verification prevents forgery

- Cost savings: No courier/postal charges

- Environmental: Paperless documentation

- Transparency: Real-time tracking of certificate status

Common Certificate of Origin Mistakes & How to Avoid Them

1. Inaccurate Goods Description

2. Incorrect Origin Designation

3. Wrong Certificate Type Selection

4. Incomplete or Missing Fields

5. Marks and Numbers Errors

6. Packaging Details Incorrect

7. Using Unauthorized Issuing Authority

8. Mismatch with Commercial Invoice

9. Expired or Late Submission

10. Failure to Retain Records

FAQs: Questions Importers & Exporters Ask About COO

Is certificate of origin mandatory for all imports?

No, a COO is not universally mandatory for all imports. For standard imports without FTA benefits, many countries do not require a COO unless specific regulations apply.

What happens if I import without a valid COO?

Customs will apply the higher standard MFN duty rates instead of preferential rates.

How long should importers keep COO records?

Under CAROTAR 2020 and Indian customs regulations, importers must retain all records related to certificate of origin and origin claims for a minimum of 5 years from the date of import.

Can one COO cover multiple shipments?

Yes, blanket certificates of origin can cover multiple shipments under certain conditions:

- Goods must be identical across all shipments

- Maximum blanket period is typically 6-12 months depending on the agreement

- Each shipment must reference the blanket certificate number

However, most FTAs require individual certificates per shipment. Check the specific trade agreement for blanket period provisions